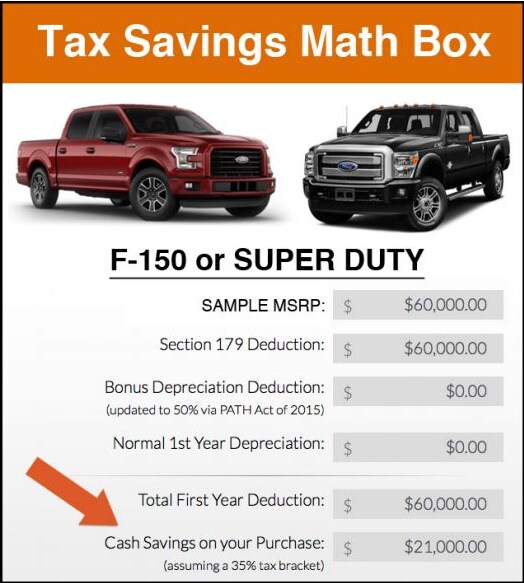

Section 179 of the IRS tax code allows businesses to deduct up to the full purchase price of qualifying equipment purchases or financed during the 2016 tax year.

That means that if they buy a piece(s) of qualifying equipment, including trucks, vans, and SUVs, they can deduct up to the Full Purchase Price from your gross taxable income.

It's an incentive created by the U.S. Government to encourage businesses to buy equipment and invest in themselves.

2015

- Write-off up to $25,000 of the purchase price on a new Ford truck, van, or SUV over 6,000lbs. GVWR., on their 2015 IRS tax return.

+

- Only normal depreciation over the next several years.

- Write-off up to $500,000 worth of one or more new Ford trucks or vans over 6,000lbs. GVWR., on their 2016 tax returns.

+

- Write-off up to $25,000 of the purchase price, plus 50% Bonus Depreciation of the remaining balance on Ford Expedition on their 2016 IRS tax return.

Let us know if you have any questions!

* Indicates a required field

Contact

Jarrett-Gordon Ford Winter Haven

3015 Lake Alfred Road

Winter Haven, FL 33881

- Sales: 863-294-3571

- Service: 863-294-3571

- Parts: 863-295-9375